Companies are tightening their belts.

The growth-at-all-costs mentality is dead. Now, businesses are having to prioritize bottom-line impact over top-line revenue.

To maintain efficient growth, tech CFOs are keeping a close eye on important SaaS financial metrics.

We talked to five powerhouse finance leaders to get a pulse on the key SaaS metrics they are obsessing over or thinking differently about.

Here’s what they had to say:

1. Rule of 40

Alyssa Filter, former CFO at Tropic, is carefully monitoring efficiency metrics like the Rule of 40.

According to Bain, the Rule of 40 is a high-level organizational health check that measures the balance between growth and efficiency. It’s based on the idea that:

Here’s the caveat: Achieving the Rule of 40 in a single year is certainly commendable, as smaller companies can often beat this metric with rapid growth. However, beating this metric year after year is exceptional and requires efficiency improvements that help maintain consistent performance and healthy profit margins, which is a struggle for larger companies where growth has staggered.

“Growing at top decile rates but rapidly burning cash is no longer the gold standard in tech companies,” says Alyssa. “In today's macro environment, it is more important than ever to balance efficiency and profitability.”

With the growth-at-all-costs mindset behind us, the Rule of 40 helps CFOs and finance leaders track and improve efficiency and focus on the bottom line.

Maintaining strong performance and profit margins to beat this metric over a long period is a sign that a company is operating in a mature manner and driving sustainable growth.

“The most highly coveted, highly valued companies effectively manage both growth and efficiency. They deliver on sustainable growth," explains Alyssa. "It’s why I’m watching efficiency metrics–most notably the Rule of 40–like never before.”

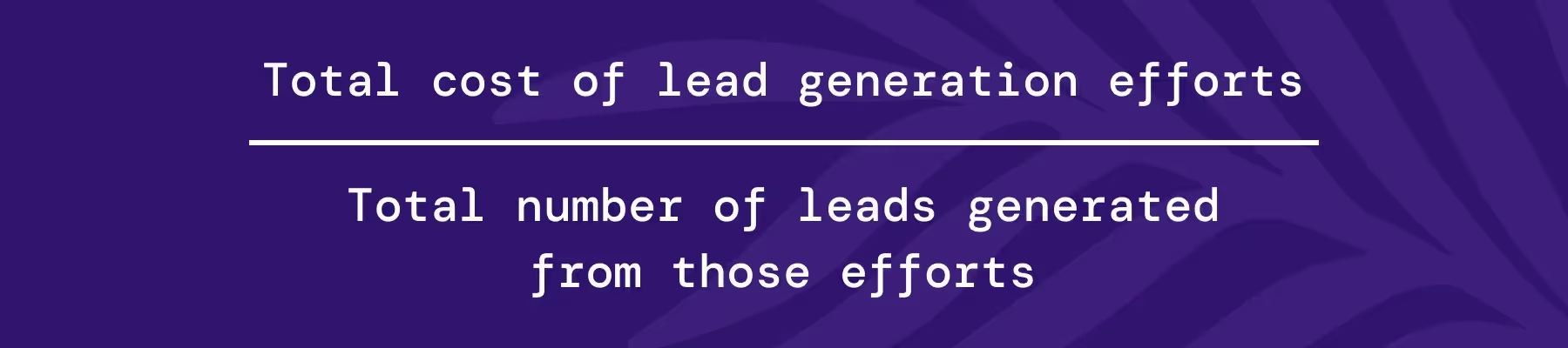

2. Cost Per Lead

Nick Zaharchuk, AVP of Finance at Wunderkind, is spending his time thinking about pipeline return, most notably Cost Per Lead (CPL), as it relates to marketing cost metrics.

According to Hubspot, CPL is an important metric to gauge efficiency as it measures the average cost of every lead your business generates. It can be measured like this:

Nick is seeking a balance between growth and efficiency as he finds himself trying to “drive profitability improvements and preserve healthy unit economics.”

To reach this financial equilibrium, where exactly is he starting?

“We know we need to take a diligent approach to setting Marketing budgets to meet pipeline requirements and sales goals efficiently,” says Nick. “This starts with an understanding of the cost to produce a unit of pipeline.”

While the objective for any business in this challenging environment is to keep pipeline return metrics (like CPL) flat or down over time, he acknowledges that it might not be realistic for this metric to stay flat, at least across certain channels.

“We're spending a lot of time on that balancing act between wanting to drive YoY improvements in our demand generation efficiency while acknowledging that we need to recognize that less demand makes the yield on some marketing investments more challenging,” explains Nick. “We’re focused on picking the right middle ground between those two things.”

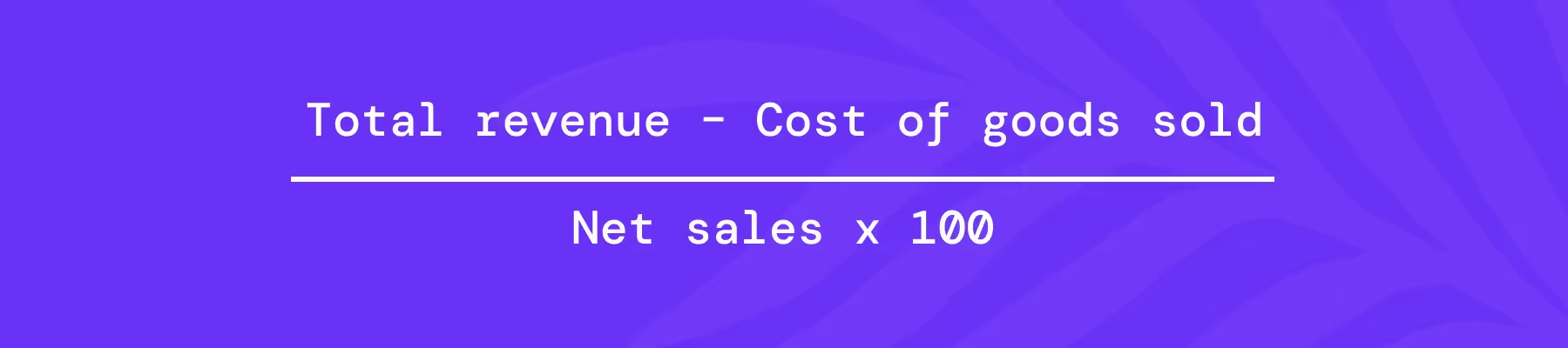

3. Gross Margin

CJ Gustafason, CFO at PartsTech and author of Mostly Metrics, is obsessing over Gross Margin to maintain profitability.

Gross margin measures either the amount or percentage of revenue a company keeps after deducting the expenses tied to delivering the product or service (think cost of labor and materials; also known as the cost of goods sold). According to Paddle, it’s one of the most important metrics to gauge a company’s financial health and it can be measured by these two formulas:

To calculate gross margin by dollar amount:

To calculate gross margin by percentage:

Gross margin allows CFOs and finance leaders to understand an organization’s ability to control costs. According to CJ: “Gross margin is a reflection of your company’s operating leverage. It’s difficult to run an efficient ship if you only have 70 cents on each dollar left to run the rest of the company. If you can get it to 80 cents, it’s an entirely different ball game.”

Tracking this metric over several reporting periods gives organizations a strong indicator of how efficient business operations are over time. In addition, comparing this metric to other companies in the industry also allows a business to see how they stack up.

As important as it is, gross margin tends to get overlooked.

“Remember: Operating expenses aren’t the only place you should be reducing costs. Many companies are laser-focused on free cash flow, but don’t spend enough time optimizing their cost of revenue along the way,” explains CJ. “You simply can’t get to free cash flow without passing through this part of the income statement.”

As he says, “Gross margin is the gateway to profitability.”

4. Annual Recurring Revenue

Ben Murray, a fractional CFO and founder of The SaaS CFO, is concentrating on how Annual Recurring Revenue (ARR) is measured to improve planning and forecasting throughout the year.

ARR measures the amount of yearly revenue a business generates from term-based customer agreements. According to Maxio, most businesses generally calculate ARR like this:

However, interpreting what exactly is recurring, or predictable, revenue has become a current challenge because modern companies continue to embrace complex pricing models to remain flexible for customers.

“Are you defining ARR correctly in your organization? It seems like such a basic metric, but it has become more complicated as pricing and business models have evolved in SaaS,” explains Ben.

While traditional subscription models offer finance teams a fixed way to calculate ARR, dynamic packages like usage and seat-based models make it harder to determine what falls under ARR.

For Ben, determining (and revisiting) this part of the business is as fundamental as eating a healthy meal. Defining ARR is a critical step for CFOs and finance leaders to properly analyze, report, and forecast performance, especially when efficiency and profitability are priorities in 2024.

“Your ARR definition impacts how you forecast your revenue streams, how you create your MRR (monthly recurring revenue) schedules, and how you calculate revenue retention and related SaaS metrics.”

5. Net Promoter Score

Chris Ortega, a fractional CFO and founder of Fresh FP&A, is focused on leveraging and expanding Net Promoter Score (NPS) to better align financial strategies and tactics.

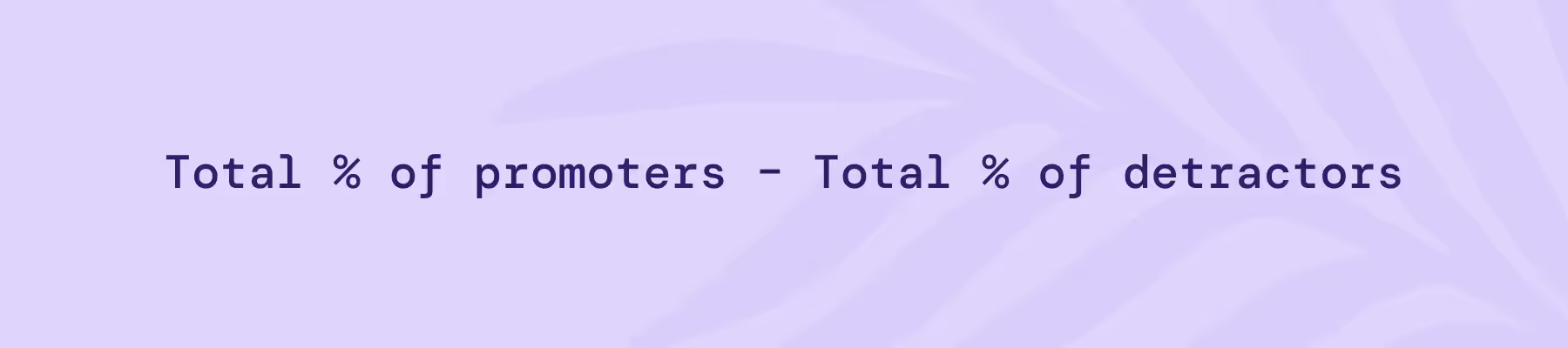

NPS is a staple metric within customer success programs as it tracks customer satisfaction and growth potential by measuring the likelihood of a customer recommending your business through a scored survey that determines promoters (those who recommend your business), passive (the neutral group), and detractors (those who would not recommend your business). According to Qualtrics, calculating NPS looks like this:

The responsibilities of CFOs and finance leaders have expanded from traditionally isolated seats to more cross-functional collaboration that drives better efficiency and strategic planning. As Chris says, “There’s a reliance on the quantitative and qualitative side of the business now.”

“While it is a quantitative metric that gives quantifiable insights, the concept of the Net Promoter Score adds a qualitative element that can give CFOs critical insight and feedback into the satisfaction of your people and potential for growth that ultimately informs your planning,” he explains.

Expanding the use case of measuring NPS beyond its traditional method is what Chris sees as a major advantage for finance teams. It’s what he does with the companies he works with – increase the frequency of touchpoints (semi-annually or quarterly surveys) and partner with multiple external and internal groups (customers, prospects, partners, and employees) to measure NPS and gather valuable feedback.

This approach gives him more data points to consistently align action around increasing that score, which can ultimately benefit the overall performance, health, and efficiency of the business in the long run.

“If you can gather more pulses from different internal and external stakeholders at an increased frequency, you’ll have more insights, feedback, and baselines into organization satisfaction and growth potential that you can align strategy and tactics to,” says Chris.

Related blogs

Discover why hundreds of companies choose Tropic to gain visibility and control of their spend.