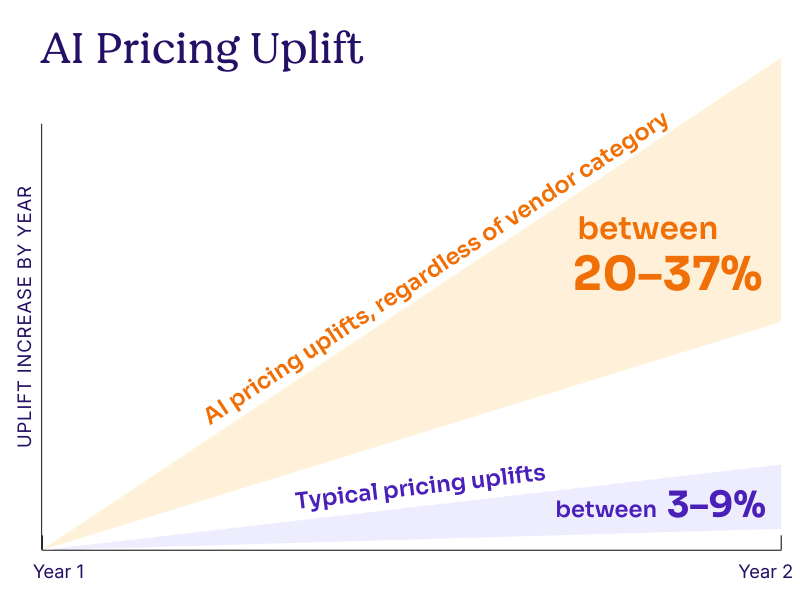

Software vendors are imposing AI-driven price increases of 20-37% on enterprise renewals through forced SKU migrations and credit-based pricing. Tropic data shows buyers who negotiate reduce vendor asks by 55%, though final pricing still lands 12% above pre-AI baselines. Fewer than one-third of companies can measure AI ROI. Finance leaders can counter these strategies by starting renewals 60+ days early, requesting legacy pricing explicitly, demanding credit consumption transparency, and requiring outcome-based justification before accepting premium pricing.

AI is no longer a future investment. It’s a line item.

Over the last 12–18 months, nearly every enterprise software vendor has repositioned itself as an “AI company.” On the surface, that sounds like innovation. Underneath, something more structural is happening.

Software buyers are quietly absorbing what we’ve started calling the AI Tax, a new, normalized cost premium justified by AI, but rarely tied to provable business outcomes.

And the tax is compounding.

The AI Tax Is Already Here, Whether You Budgeted for It or Not

Based on a real-world dataset of AI-driven software renewals and expansions across Tropic customers, several key findings emerged:

- AI pricing uplifts sit between 20–37%, regardless of vendor category

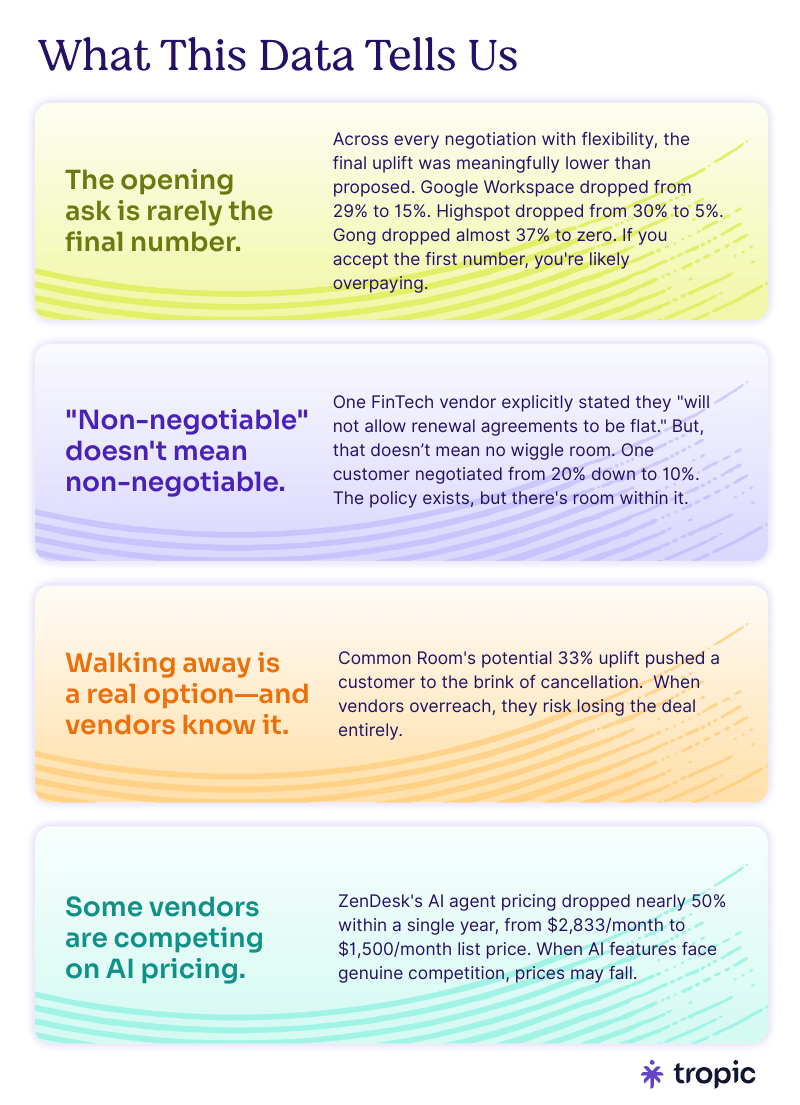

- Proposed AI-driven increases are consistently higher than final negotiated outcomes, indicating meaningful pushback can work

- Negotiation reduces the initial vendor ask by ~55% in relative terms, but final pricing still lands materially above pre-AI baselines (average final uplift ≈ 12%)

- Vendors with strong platform lock-in (Slack, Microsoft-adjacent, finance systems) show the least pricing flexibility

- “AI justification” is frequently disconnected from new functionality, with pricing rising faster than perceived incremental value

- As companies look at when to spend on AI, it's often less about wanting the AI functionality, and more about whether spending more now, or later, allows them to save the most money on something inevitable

- Four distinct vendor tactics have emerged: forced SKU migrations, unbundling/rebundling, credit-based obfuscation, and conditional discounts with bundled AI SKUs—not optional add-ons being the most dominant pricing mechanism

- There is the rare occasion where vendors are actually reducing AI pricing due to competitive pressure

Why Vendors Are Pushing the AI Tax Now, And How to Push Back

This moment makes sense when you look at vendor incentives.

AI infrastructure is expensive. Model training, inference costs, and massive CapEx investments are putting pressure on margins, especially for public companies and late-stage startups facing investor scrutiny.

If vendors can’t show AI-driven revenue uplift, the entire economic narrative behind today’s AI valuations starts to wobble.

So revenue has to come from somewhere.

And, they know that there is a lot of pressure to adopt AI. A new Bain study shows that “AI is becoming more important to companies: 74% say it’s a top-three strategic priority (vs. 60% a year earlier), and 21% call it their top priority.”

But, even with that desire, what we’re seeing instead of organic demand is forced monetization, typically in four forms:

- The Forced SKU Migration: Vendors consolidate existing tiers into new AI-inclusive packages, eliminating the option to renew at previous pricing.

- Example: Slack merged Enterprise Select ($20/user/month) and Enterprise Grid ($32/user/month) into Enterprise+ at $45/user/month.

- How to respond: Start renewal conversations 60+ days early. Request as-is renewal pricing explicitly. Make them say no. If forced to migrate, negotiate hard on per-user rates.

- Credit-Based Obfuscation: Vendors move from predictable per-seat pricing to consumption-based "credit" models that obscure true costs and make benchmarking nearly impossible.

- Example: HubSpot transitioned to credit-based pricing for AI features. Instead of paying for Breeze AI separately, usage pulls from a pool of credits. What constitutes one credit? It varies by action. How do you forecast costs? You can't without usage history.

- How to respond: Demand transparency on credit consumption per action type. Build contract language that caps overages. Negotiate mid-term review clauses if consumption exceeds estimates.

- The Unbundling-Then-Rebundling Play: Vendors break apart all-in-one products into multiple SKUs, then position AI features as premium add-ons required to restore previous functionality.

- Example: Gong shifted from bundled features to an a-la-carte model. Customers now pay ~$1,400 for Gong Foundations versus $1,000 for Gong Professional last year, 40% more for a base product that includes less.

- How to respond: Map your current feature usage against the new SKU structure. Challenge whether you actually need each add-on. Use competitive pressure and shop around.

- The Conditional Discount: Vendors offer discounts on base products only if you agree to purchase AI add-ons, reframing AI adoption as a savings opportunity rather than an additional cost.

- Example: GitLab offers 5% off Premium if you don't buy GitLab Duo. But bundle Premium with Duo? You get 12% off Premium plus 30% off Duo. Webflow will waive their standard 5-7% annual uplift entirely if you purchase their new AI tools.

- How to respond: Evaluate the AI product independently of the discount. If you weren't going to buy it at full price, the "savings" aren't real. Ask for discounted base pricing without the AI commitment, you might get it.

Many companies are also creating contractual structures that make AI spend difficult to cap or forecast.

Your counter-strategy should like:

- Evaluate the AI product independently of the discount

- Calculate the true cost: base product at full price vs. base + AI at discounted price

- If you weren't going to buy the AI product at full price, the "savings" aren't real

- Ask for the discounted base pricing without the AI commitment, you might get it

- Request a trial or POC period for the AI features before committing

The Real Problem: Less Than a Third of Companies Can Prove AI ROI

The AI Tax wouldn’t be so hard to swallow, if we were all seeing the value. Instead, fewer than one-third of companies can tie AI investments to measurable P&L impact.

That doesn’t mean AI isn’t valuable. It means the value is hazy.

Revenue uplift is easy to defend. Efficiency gains – time saved, cognitive load reduced, work accelerated – are much harder to quantify. Most organizations still lack the instrumentation to convert “hours saved” into economic outcomes.

The Value Capture Problem

My theory on why AI ROI is so hard to measure: the value is being captured by employees, not organizations.

An account executive with AI tools can hit quota in 75% of the time it took before. Where does that extra 25% go? In many cases, it goes to better work-life balance—not redeployable business capacity.

Companies can't detect this. Can't measure it. So employees are disproportionately capturing efficiency gains while leadership struggles to justify the investment.

As a result:

- CFOs are asked to absorb material cost increases without clear returns

- Procurement teams are left defending spend they didn’t choose

- Business leaders feel AI value anecdotally, not financially

The companies at the forefront of AI (i.e. Amazon, Microsoft, etc.) are making decisive organizational changes because they've built the measurement infrastructure to see where value actually lands. Everyone else is flying blind.

Why this matters to you: Before accepting AI-driven price increases, build your own measurement framework. Track time savings, output quality, and capacity created. If you can't measure AI value, you can't justify AI costs.

Legacy Vendors vs. AI-Native Tools: Two Very Different Dynamics

Not all AI spend is created equal.

Large incumbents—Microsoft, Salesforce, Google—can impose AI pricing simply because of lock-in. They sit so deeply in enterprise workflows that switching costs outweigh price resistance.

AI-native startups, on the other hand, behave differently.

They’re faster to adopt, faster to test, and, critically, faster to turn off. Many deliver immediate value with minimal implementation overhead. That makes them powerful experimentation tools, but also highly disposable if outcomes don’t materialize.

This creates an interesting paradox:

- Legacy platforms extract the largest AI tax

- AI-native tools often deliver the clearest productivity gains

- Procurement teams must manage both simultaneously

There isn’t so much risk in experimenting, but there is risk in letting experimentation quietly turn into permanent spending.

The Coming Reckoning: Budget Pressure, Consolidation, and Pushback

While Gartner is predicting a 15% increase in software budgets, we can guarantee CFOs are going to want a lot more for that 15%. Not just to pay more for the same thing. So, when all of your renewals come back with 25% AI tax, that math isn’t going to math. CFOs aren’t adding 25% to software budgets year over year. That math doesn’t math.

So, what happens next is predictable:

- Increased scrutiny on renewals

- Forced prioritization across overlapping tools

- Consolidation of vendors that can’t prove differentiated value

When every vendor asks for more, some vendors will get cut. The AI Tax is accelerating a long-overdue reckoning in software procurement, one where outcomes matter more than narratives.

How Leaders Should Respond to the AI Tax

AI isn’t going anywhere, and as we’ve already talked about, we’re on the cusp of cracking the true ROI it brings. So, realistically, the answer isn’t “no AI,” but it is very much about buying it differently.

- Demand Outcome-Based Justification: Ask vendors to show how AI impacts revenue, conversion, cost, or capacity—not just feature velocity.

- Treat AI Like a Pricing Model Change, Not a Feature: Bundled AI changes the economics of contracts. Negotiate protections accordingly.

- Watch Credit-Based Pricing Closely: If you can’t clearly explain how credits are consumed, forecasted, and capped, you don’t control the spend.

- Build Flexibility Into Contracts: Mid-term checkpoints, SKU protections, and exit optionality matter more than ever.

- Resist FOMO-Driven Purchasing: AI adoption should start with a business hypothesis, not a vendor demo.

The Bright Spot: Where Some AI Pricing Is Becoming More Competitive

Not every AI pricing story is negative. Our initial review of negotiations reveals some situations where competitive pressure is benefiting buyers.

ZoomInfo: AI as Negotiation Leverage

One customer exploring three options—downgrade to Chorus, flat renewal, or upgrade to Copilot + ABM—discovered that Copilot could be added at no additional cost, potentially even reducing total contract value below their previous Elite+ pricing.

- Why it's happening: ZoomInfo faces intense competition from Apollo.io, Clay, Cognism, and others. They're using AI features as retention tools rather than revenue drivers.

- Your takeaway: When evaluating vendors in competitive categories, AI features become negotiating chips rather than cost centers.

ZenDesk: The Price Correction

ZenDesk's AI agent pricing dropped from $2,833/month list price at the start of 2025 to $1,500/month currently, an almost 50% reduction within a single year.

- Why it's happening: The AI customer service space is crowded. Early pricing didn't stick when buyers had alternatives.

- Your takeaway: First-mover AI pricing often corrects downward. If you signed an AI-inclusive contract in early 2025, you may be overpaying relative to current market rates.

Planful: AI as Optional Value-Add

- Planful is offering AI as a genuine optional add-on—roughly $12K list, negotiated to $6.6K—rather than forcing upgrades. Customers who want AI can buy it; those who don't aren't penalized.

- Why it matters: This is how AI pricing should work. Value-based, optional, negotiable. Use vendors like Planful as a benchmark for what "fair" AI pricing looks like.

7 Action Steps for Your Next AI-Affected Renewal

1. Audit Your Renewal Calendar Now

Identify every renewal in the next 12 months for vendors likely to push AI pricing: Slack, Gong, Google Workspace, HubSpot, Microsoft, Salesforce, GitLab/GitHub, just to name a few, and any vendor who's mentioned "AI enhancements" recently.

Create a tiered response plan:

- High risk (>$100K contracts, known AI pushers): Start 6+ months out

- Medium risk ($25-100K, competitive category): Start 90 days out

- Lower risk (<$25K, optional tools): Standard 60-day process

2. Request Legacy Pricing Explicitly

Never assume new SKU structures are mandatory. Ask directly: "What would a renewal at our current tier and feature set cost?"

Document the response. Even if the answer is no, it:

- Shifts the conversation to your terms

- Creates a paper trail for escalation

- Forces the vendor to justify the change

3. Build Price Protection Into Every Contract

Treat AI as a pricing model change, not a feature. Negotiate AI as a contract economics shift and negotiate these terms before you need them:

- Renewal caps: Target 0-2%, accept up to 5%

- SKU protection: Language preventing forced migrations without consent

- Mid-contract review clauses: Right to renegotiate if pricing models change

- Price lock on additions: Guaranteed rates for adding users or features

4. Push Back on Credit Opacity

If a vendor proposes credit pools:

- Require precise definitions, consumption reporting, and hard caps.

- Negotiate credits as disentanglable line items.

5. Create Genuine Competitive Alternatives

The vendors making the biggest concessions in our data are facing real competition:

- ZoomInfo is flexible because Apollo and Clay exist

- Gong negotiates because Clari/Salesloft are options

- Slack faces pressure from Microsoft Teams and Google Chat

Identify your alternatives before renewal conversations begin. Get price benchmarks, and when possible, real quotes. The threat of switching only works if it's credible.

6. Separate AI Evaluation from Renewal Timing

Don't let vendors force AI purchase decisions during renewal pressure. Instead:

- Request trial access to AI features with no commitment

- Run internal pilots with clear success metrics

- Evaluate AI value independently of discount structures

- Make AI decisions on your timeline, not theirs

7. Demand ROI Evidence Before Paying Premiums and Build an AI Procurement Playbook

When vendors claim AI features justify 20-30% increases, ask:

- What productivity improvements have similar customers seen?

- What's the average adoption rate for these features?

- Can you connect us with a reference customer our size?

- What usage data do you provide to help us track ROI?

- What metrics will you prove?

If they can't answer these questions, they haven't earned premium pricing.

Then standardize:

- Template contract clauses for AI (price protection, credit definitions, measurable outcomes, EBR cadence).

- A “AI impact checklist” for business stakeholders to justify adoption beyond FOMO.

The AI Tax Is Real, But It's Negotiable

Every finance and procurement leader will face AI-driven price increases over the next 12-24 months. The vendors pushing the most aggressive increases are also making the biggest concessions when buyers push back.

The question isn't whether you'll pay an AI tax. It's whether you'll pay full price or negotiate from a position of strength.

The vendors winning right now are those who:

- Start with aggressive asks (20-37%+ uplifts)

- Bundle AI into mandatory packages

- Obscure pricing through credits and complex SKU structures

- Create artificial urgency around "limited" legacy pricing

The buyers winning right now are those who:

- Start renewal conversations early (6+ months for major contracts)

- Request legacy pricing explicitly and document responses

- Build genuine competitive alternatives

- Demand ROI evidence before accepting premium pricing

- Build price protection into contracts before they need it

Frequently Asked Questions About the AI Tax

What is the AI Tax in software pricing?

The AI Tax refers to the 20-37% price increases software vendors are adding to renewals by bundling AI features, whether customers use them or not. These uplifts typically come through forced SKU migrations, credit-based pricing models, or mandatory feature bundles that make AI adoption feel required rather than optional. Tropic data shows negotiation can reduce vendor asks by approximately 55%, though final pricing still lands 12% above pre-AI baselines on average.

How much are software vendors increasing prices for AI features?

Based on analysis of real-world contract data, AI-driven price increases typically range from 20-37% depending on vendor category and platform lock-in strength. Vendors with strong lock-in like Slack, Microsoft, and enterprise finance systems show the least pricing flexibility. However, buyers who negotiate strategically can reduce these increases significantly, with final negotiated pricing averaging around 12% above previous rates rather than the initial 20-37% asks.

Why are software vendors pushing AI price increases now?

Vendors face pressure to monetize AI investments due to expensive infrastructure costs for model training and inference, especially public companies and late-stage startups under investor scrutiny. With 74% of companies calling AI a top-three strategic priority according to Bain research, vendors know there's organizational pressure to adopt. If vendors can't demonstrate AI-driven revenue uplift, their AI valuations become unsustainable, forcing monetization through existing customer relationships.

What are the four vendor tactics for imposing AI pricing?

Vendors use four distinct pricing tactics: (1) Forced SKU migrations that consolidate existing tiers into new AI-inclusive packages eliminating renewal at previous pricing, (2) Credit-based obfuscation moving from predictable per-seat pricing to consumption models that obscure true costs, (3) Unbundling-then-rebundling that breaks products into multiple SKUs positioning AI as premium add-ons to restore previous functionality, and (4) Conditional discounts offering base product discounts only if you purchase AI add-ons, reframing AI as a savings opportunity.

How can I negotiate better terms on AI-driven price increases?

Start renewal conversations 60-180 days early for major contracts to maximize leverage. Request explicit legacy pricing at current tier and feature sets, forcing vendors to justify changes. Build price protection into contracts including renewal caps of 0-5%, SKU protection language preventing forced migrations, and mid-contract review clauses. Create genuine competitive alternatives by identifying options before renewal discussions and obtaining real quotes. Demand transparency on credit consumption with hard caps if vendors propose consumption-based models.

Why is AI ROI so difficult to measure for most companies?

Fewer than one-third of companies can tie AI investments to measurable P&L impact because employees often capture efficiency gains rather than organizations. When an account executive using AI tools hits quota in 75% of the time, that extra 25% frequently goes to improved work-life balance rather than redeployable business capacity. Most organizations lack instrumentation to convert "hours saved" into economic outcomes, making revenue uplift easy to defend while efficiency gains remain difficult to quantify for leadership justification.

Should I accept conditional discounts that require purchasing AI add-ons?

Evaluate AI products independently of any discount offered. Calculate true cost by comparing base product at full price versus base plus AI at discounted price. If you weren't planning to purchase the AI product at full price, the "savings" aren't genuine value. Request discounted base pricing without AI commitment—vendors may agree. Demand trial or proof-of-concept periods for AI features before committing to ensure the functionality delivers measurable value for your specific use case.

How do credit-based AI pricing models affect budgeting?

Credit-based pricing obscures true costs because credit consumption varies by action type and makes forecasting nearly impossible without usage history. If you cannot clearly explain how credits are consumed, forecasted, and capped, you don't control the spend. Demand transparency on credit consumption per action type, build contract language that caps overages, and negotiate mid-term review clauses if consumption exceeds estimates. Request precise definitions and consumption reporting as contract requirements.

When should I start preparing for AI-affected renewals?

Create a tiered response plan: Start 6+ months early for high-risk contracts over $100K with known AI-pushing vendors, 90 days early for medium-risk $25-100K contracts in competitive categories, and 60 days for lower-risk contracts under $25K. Identify upcoming renewals for vendors likely to push AI pricing including Slack, Gong, Google Workspace, HubSpot, Microsoft, Salesforce, and GitLab/GitHub. Early preparation allows time to evaluate alternatives, run competitive processes, and negotiate from strength rather than deadline pressure.

Are there any vendors reducing AI pricing due to competition?

Yes, competitive pressure is driving price reductions in some categories. ZoomInfo now offers AI features like Copilot at no additional cost to retain customers facing alternatives from Apollo.io, Clay, and Cognism. Zendesk's AI agent pricing dropped from $2,833/month to $1,500/month within a single year due to crowded AI customer service market. Planful offers AI as genuine optional add-on at negotiable rates rather than forcing upgrades. Use these examples as benchmarks for what fair, value-based AI pricing should look like.

Related blogs

Discover why hundreds of companies choose Tropic to gain visibility and control of their spend.