Your bottom line is our top priority

Tropic gives you visibility and control over every dollar, every contract, and every supplier in one place. It’s the spend management software, data, and services you can trust—we guarantee it.

You're in good company

Some of the most innovative companies power their purchasing with Tropic

Every drop of savings matters

Eliminate waste while boosting productivity—it’s a win-win.

Average Savings

Average Hours Saved

Average ROI

Before Tropic

- Wild West purchasing

- Contracts lost in inboxes

- Negotiating with no data

- Unused licenses & tools

- Manual and painful

After Tropic

- Employees follow process

- Contracts are centralized

- Know exactly where you'll land

- Optimize every dollar

- Easy and automated

How it works

Spend management has to balance the interests of bottom line and company efficiency. Tropic provides industry-leading tools, data, and services needed to strike that balance.

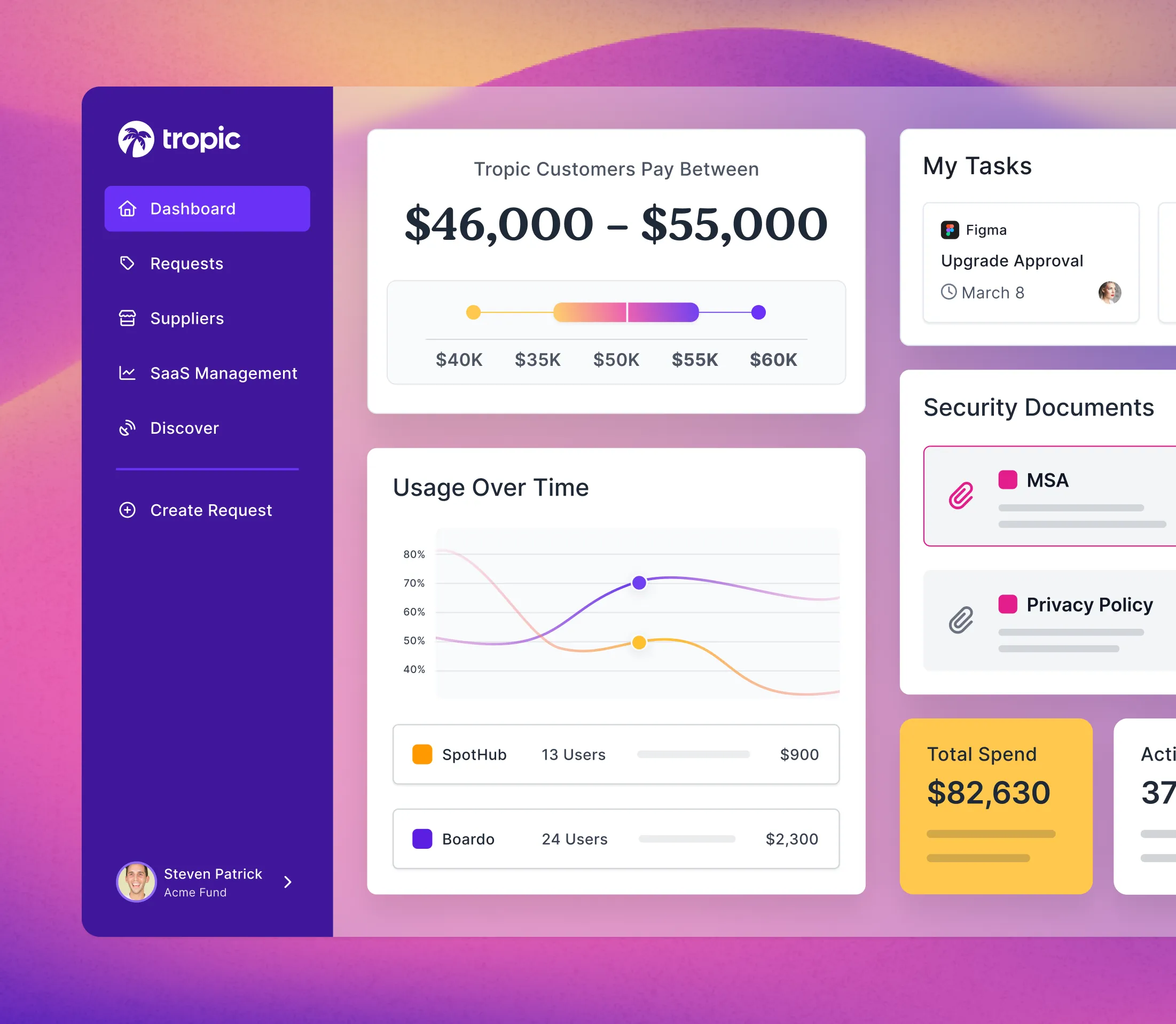

Access the holy grail of supplier data

Tap into the largest, bias-free supplier database, built from hundreds of thousands of purchases and billions of dollars in spend managed.

Discover benchmarks, common alternatives, purchasing trends, price increases. Go from research to request in one click.

Put approvals on autopilot

Liberate your team from the pain of manual approvals and onboarding processes with dynamic, no-code workflows.

Orchestrate stakeholder, IT, finance, legal, and infosec approvals automatically. Eliminate bottlenecks with a compliant process your company will actually adopt.

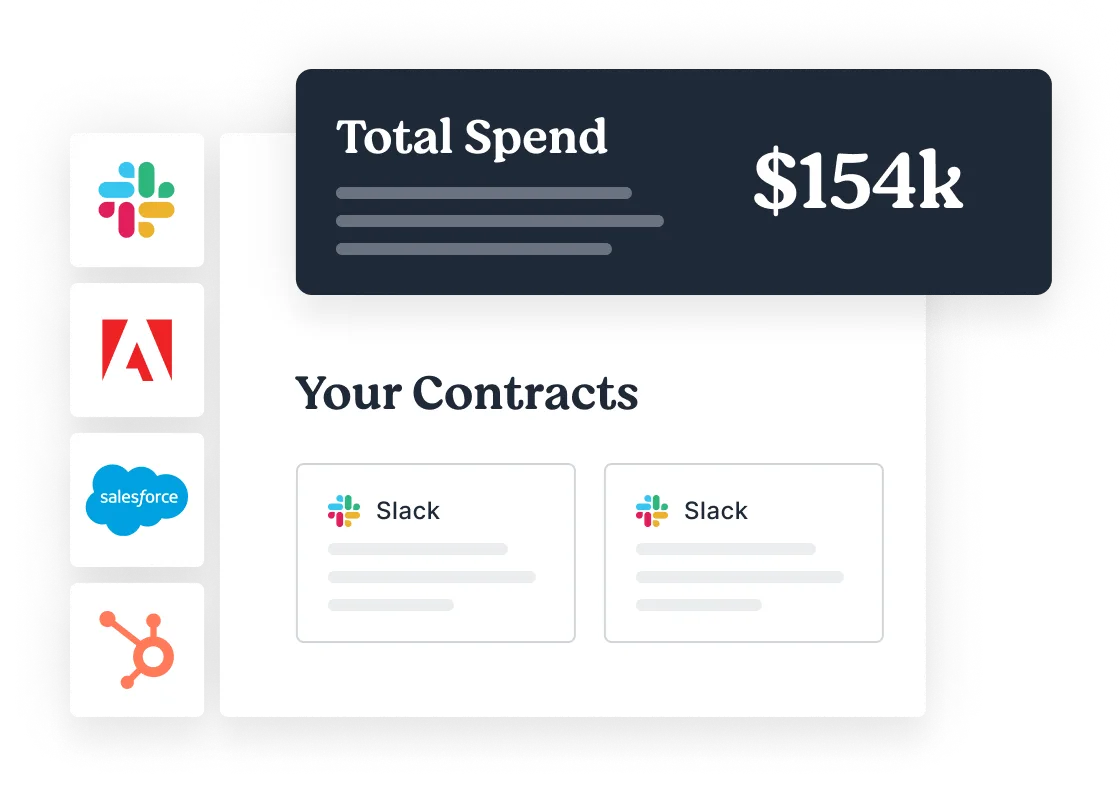

Unify contract, usage, and spend data

Tropic brings SaaS management, contract management, and spend management into one platform—your central source of truth.

Creating a 360° view of every supplier gives stakeholders the confidence to manage every dollar. After all, you can’t manage what you can’t measure.

Capture every drop of savings

Identify every savings opportunity and take action in seconds—on your terms. Rightsize agreements, eliminate shadow spend, minimize overlap, and negotiate with better leverage.

Supercharge savings outcomes with one-click procurement services that serve as your negotiation captain or first mate.

Customer 💜 is our motivation

Results are what excite us about waking up every morning. The praise is simply an added bonus that keeps us energized.

When you save, we succeed

Good service is transactional. Tropic's service is transformational. From onboarding to Assisted Purchasing, we’ve got you covered.

Industry-Leading Service

We hire and train the best, most qualified experts to serve as an extension of your team.

Expert Advisory

We’ll guide and coach you through negotiations. It’s like sailing with sonar.

Assisted Purchasing

Push the autopilot button and we’ll take control to negotiate on your behalf.